What Is No Claim Bonus (NCB)?

In the UK, a no-claims bonus (NCB) is a discount that is given to drivers on their car insurance premiums as a reward for not making any claims on their policy. This bonus can be earned by a driver each year from insurer by making a claim.

How NCB Works in UK

When you purchase a car insurance policy, you start with 0 years of NCB (No Claim Bonus). Each year you drive without making a claim, you earn one year of NCB. The NCB usually accumulates up to a maximum of nine (9) years, depending on the insurance provider.

Some insurance providers offer the option to protect your NCB after 3 or 4 years. This means that even if you make a claim, your NCB will remain intact. However, it’s important to note that protecting your NCB does not necessarily prevent an increase in your insurance premium due to a claim.

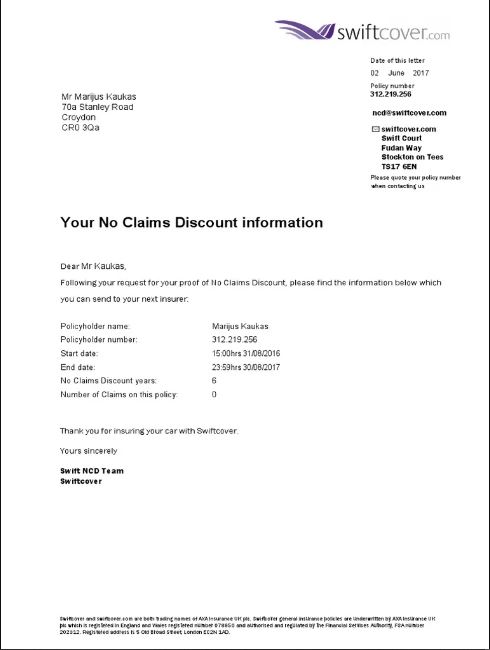

Also, the NCB is tied to the policyholder and not the vehicle. This means that if a policyholder changes their vehicle, they can still transfer their NCB to the new policy. Additionally, if a policyholder switches to a new insurance provider, they can usually transfer their NCB to the new policy.

How NCB Saves Money of Drivers

The amount of discount that a driver can earn on their insurance premium through their no-claims bonus can vary depending on the insurance provider and the policy. Typically, a driver can earn a discount of up to 30% on their car insurance premium after five years of driving without making a claim.

It’s important to note that if a driver does make a claim on their policy, they may lose some or all of their no-claims bonus, depending on the terms of their policy. Therefore, it’s often more cost-effective in the long run to pay for minor damages out of pocket instead of making a claim on the insurance policy and potentially losing the no-claims bonus.

Overall, a no-claims bonus can be a valuable way for safe and responsible drivers to save money on their car insurance premiums in the UK.